PRINT / DOWNLOAD ADLA Business Journal Ad Available3/24/25OC Business Journal Ad Available3/03/25Phoenix Business Journal Ad Available3/07/25D/AQ Corp. #01129558. Although all information is furnished regarding for sale, rental or financing is from sources deemed reliable, such information has not been verified and no express representation is made nor is any to be implied as to the accuracy thereof,...

Business

February CPI Report Inflation cooled more than expected in February, offering a potential reprieve after January’s sharp increase. The Consumer Price Index rose 2.8% year-over-year, a step down from 3.0% in January, while monthly inflation slowed to 0.2%, easing from the previous month’s 0.5% jump. Core inflation, which excludes food and energy prices, also moderated, rising 3.1% over the past...

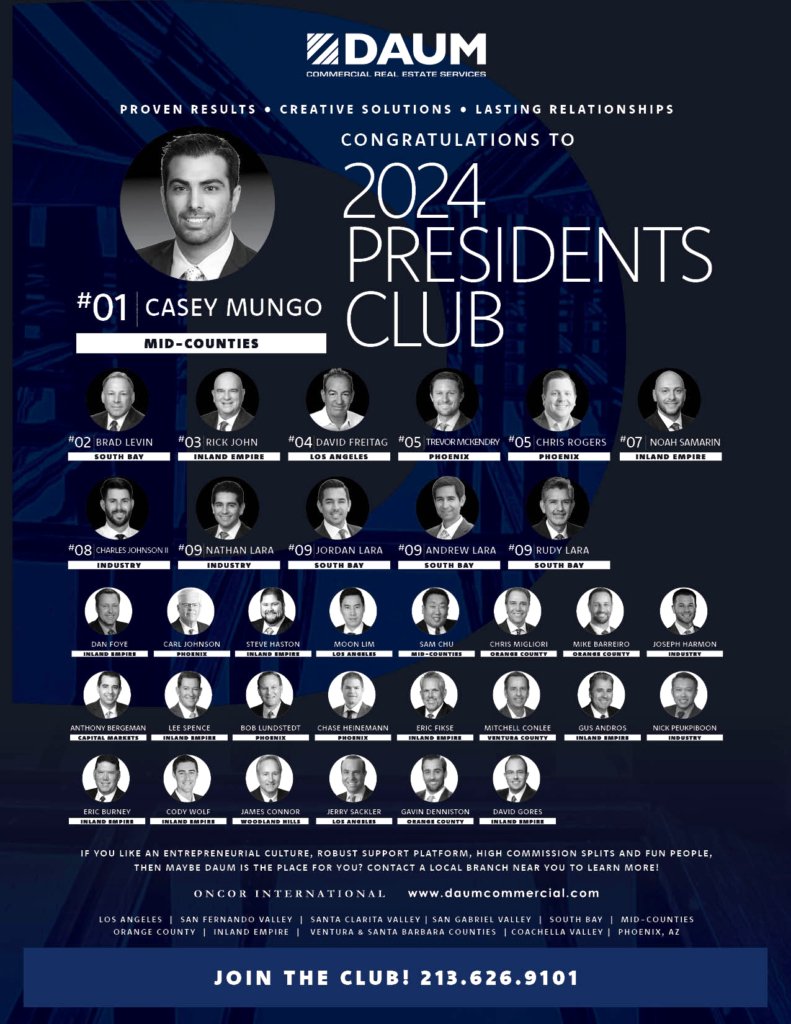

The rankings report has been updated for the month of December and Casey Mungo of DAUM’s Mid-Counties office finished the year as the #1 producer in the company for 2024, followed by Brad Levin of DAUM’s South Bay office in 2nd place, Rick John (Inland Empire) #3, David Freitag (Los Angeles) #4, Chris Rogers (Phoenix) and Trevor McKendry (Phoenix) tied at #5, Noah Samarin (Inland Empire) #7, Charles...

The Consumer Price Index was up 3.5 percent over the year through March, up from 3.2 percent in February. The core inflation, which excludes volatile food and energy prices, remained steady at 3.8 percent, surpassing the consensus prediction of a 3.7 percent rise. The persistently high core rate indicates underlying inflationary pressures, unchanged from the previous month, defying expectations of a...

Inflation was up 3.2 percent over the year through February, up from 3.1 percent in January – a monthly increase of 0.4 percent. The core inflation, the measure that excludes volatile energy and food prices, was up 3.8 percent, greater than expected but down from last month’s 3.9 percent. The owners’ equivalent rent, which...

Inflation was up 3.4 percent year-over-year through December, up from 3.1 percent in November – a monthly increase of 0.3 percent. The core inflation, a measure that excludes energy and food prices, was up 3.9 percent over the twelve months through December, down from 4.0 percent in November. This marks the first time the core index dropped below 4 percent since May of 2021. The monthly core inflation...

Inflation Higher than Expected: August ReportInflation was up 3.7 percent year-over-year through August, up from 3.2 percent in July – a monthly increase of 0.6 percent. The core inflation, a measure that excludes energy and food prices, was up 4.3 percent over the twelve months through August, down from 4.7 percent in July. The monthly core inflation in August was 0.3 percent – a bigger increase than...

David Freitag is an executive vice president and Los Angeles branch manager at DAUM Commercial Real Estate Services, where he specializes in consulting and corporate services in industrial and commercial properties. Throughout his impressive career, Freitag has achieved a personal transaction value in excess of $2.1 billion and totaling over 23 million square feet of space. His range of clients includes...

OCTOBER CPI REPORT COOLER THAN EXPECTED Inflation in October was up 7.7 percent year-over-year, down from 8.2 percent in the previous month. The Core CPI, a less volatile measure that excludes energy and food prices, increased 6.3 percent, down from 6.6 percent in the year through September. Even though still running at a historically high pace, the CPI at 7.7 percent is less than the 7.9 percent that...

GDP Declines for the Second Consecutive Quarter: Are We in a Recession? On July 28th, the first reading on Q2 GDP was released showing a contraction of 0.9 percent. This is following the Q1 contraction of 1.6 percent. The decline of GDP for two consecutive quarters is widely considered to be a recession. In the US, however, a definition is more expansive. The National Bureau of Economic Research, a...