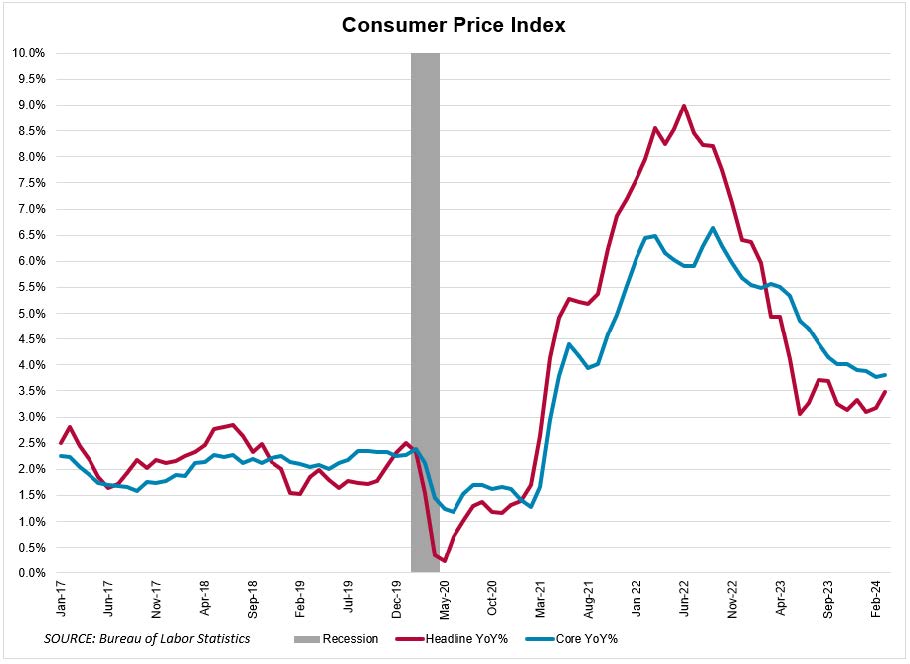

The Consumer Price Index was up 3.5 percent over the year through March, up from 3.2 percent in February. The core inflation, which excludes volatile food and energy prices, remained steady at 3.8 percent, surpassing the consensus prediction of a 3.7 percent rise. The persistently high core rate indicates underlying inflationary pressures, unchanged from the previous month, defying expectations of a decline.

The uptick in inflation casts doubts on the anticipated timeline for interest rate reductions. Despite previous forecasts of potential rate cuts, the March data suggests a stronger-than-expected inflationary environment, compelling the Fed to reconsider current projections of three rate cuts this year. The Fed has increased interest rates to 5.3 percent from near zero since 2022 to curb inflation.

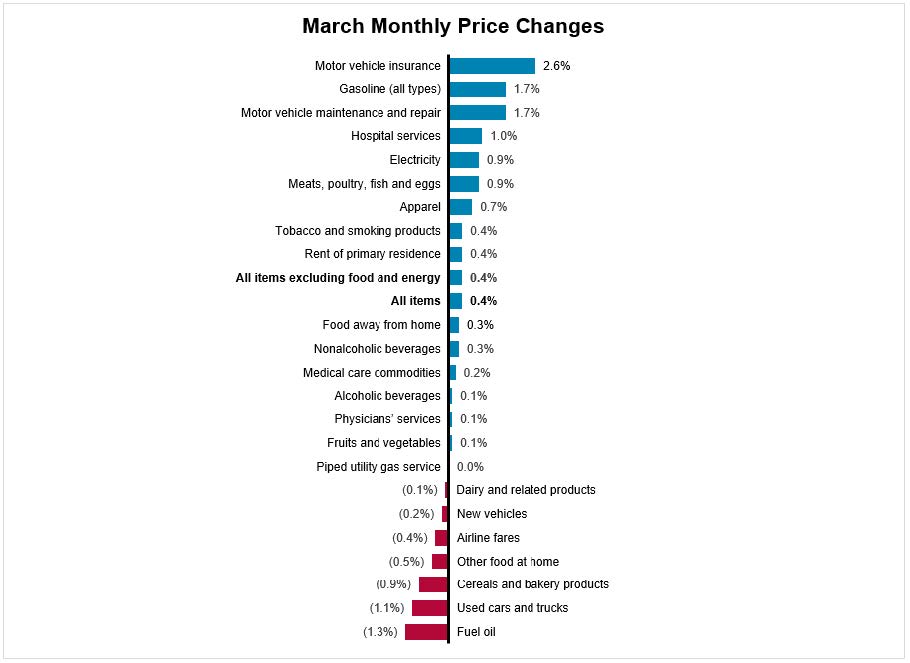

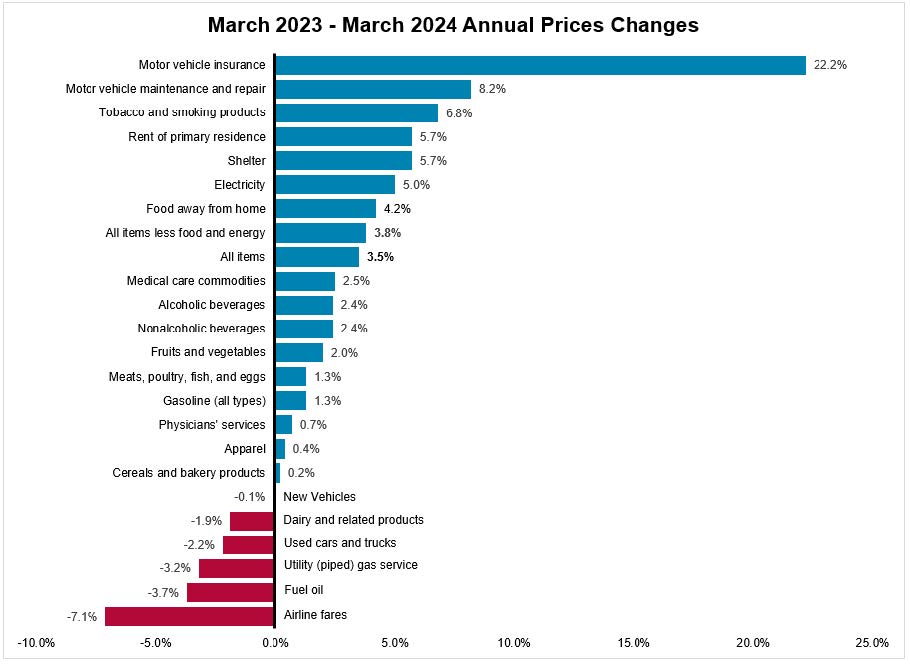

Inflationary pressures were evident across various sectors, with notable increases in motor vehicle insurance and motor vehicle maintenance and repair. Additionally, housing inflation remains robust, and service-related inflation, particularly in sectors like auto insurance and hospital services, has accelerated, reflecting ongoing economic strength and wage growth dynamics. Service inflation is of particular concern since it’s driven by wage growth and tends to be stubborn.