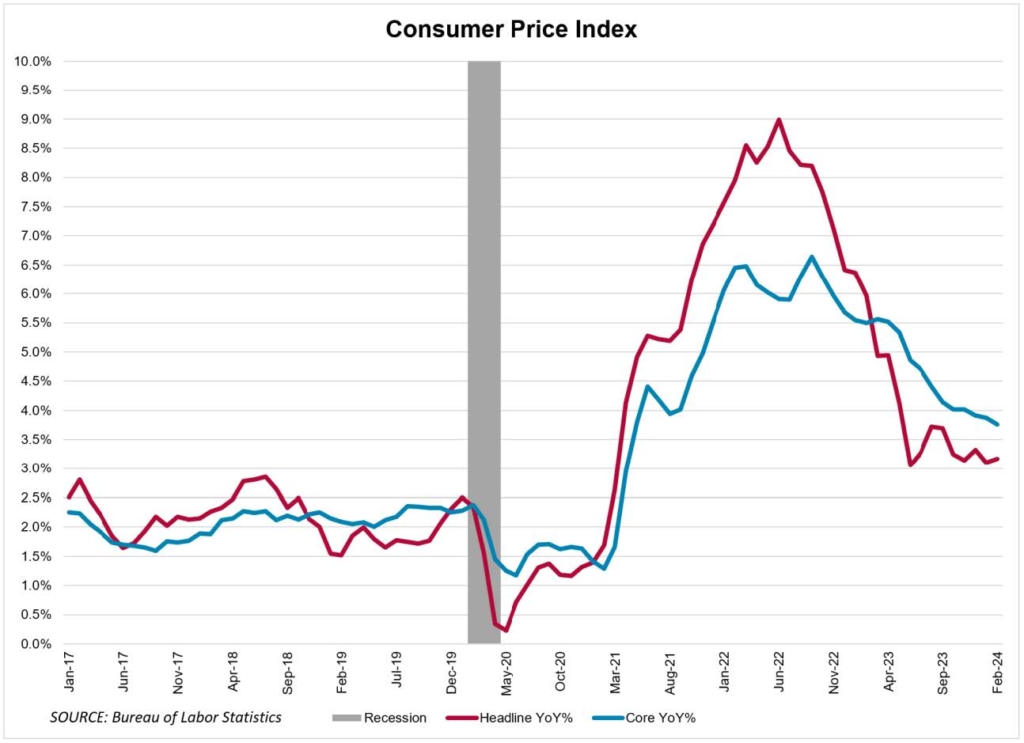

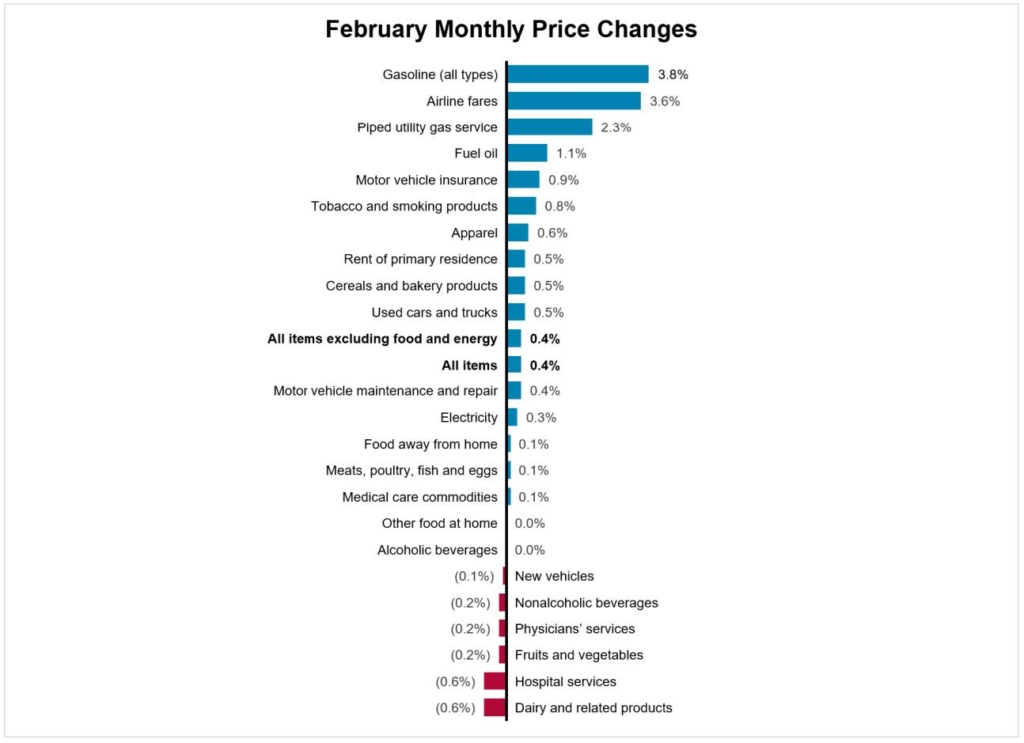

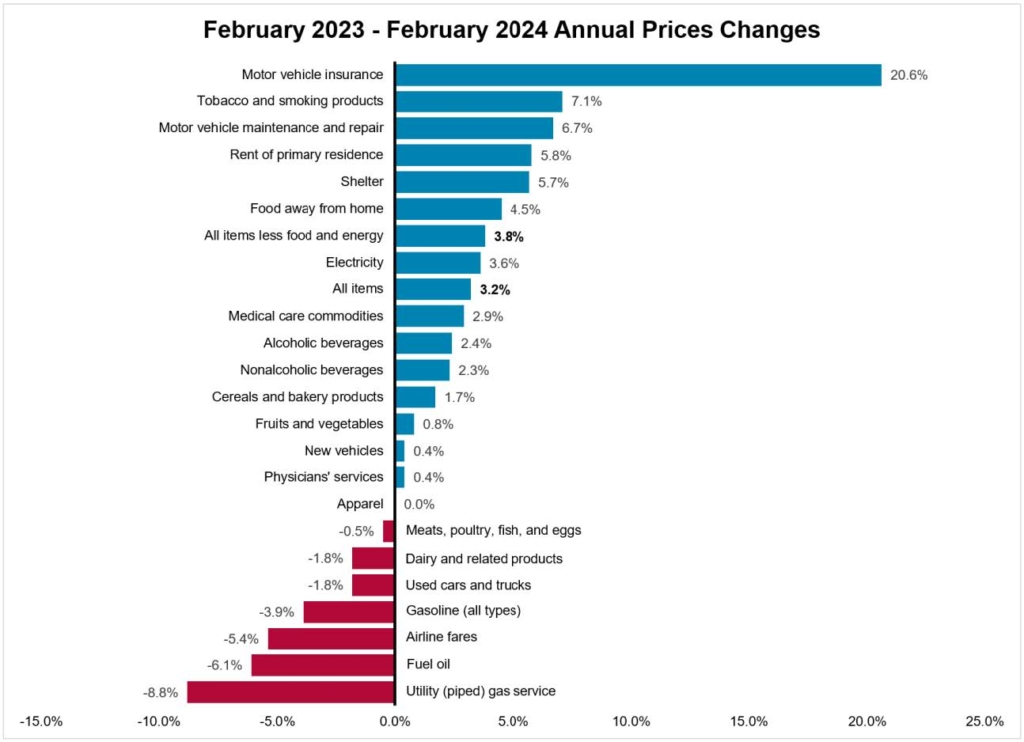

Inflation was up 3.2 percent over the year through February, up from 3.1 percent in January – a monthly increase of 0.4 percent. The core inflation, the measure that excludes volatile energy and food prices, was up 3.8 percent, greater than expected but down from last month’s 3.9 percent.

The owners’ equivalent rent, which approximates the cost of ownership, declined from 0.6 to 0.4 percent. However, the rent of primary residence component came in at 0.5 percent compared to 0.4 percent in January. Housing remained the largest component in the core CPI. On the other hand, food prices gains were relatively stable.

The report underscores the difficulty of bringing down inflation the last couple of points to the 2 percent target and it justifies the Fed’s cautious approach to cutting rates. The Fed’s main task is to keep the rates high at 5.3 percent just long enough to bring the inflation down to the target rate, but not too long so that the economy slips into a recession. So far, the Federal Reserve’s policy has brought inflation down from the 9.1 percent high in 2022 down to current levels relatively painlessly with unemployment under 4 percent and with a strong growth in 2023.