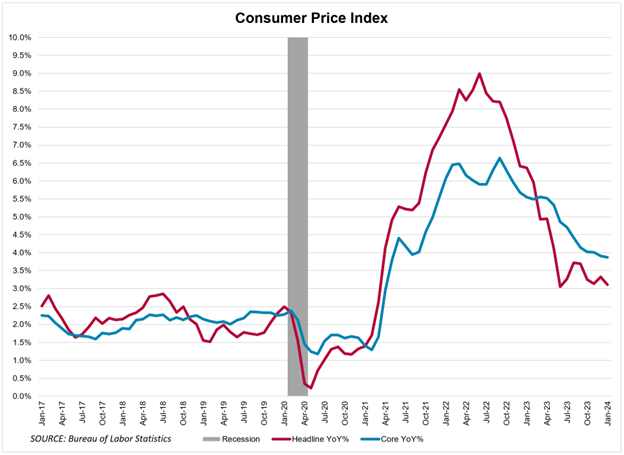

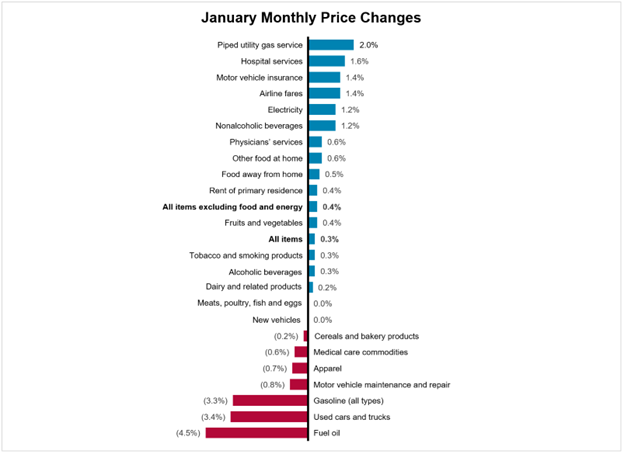

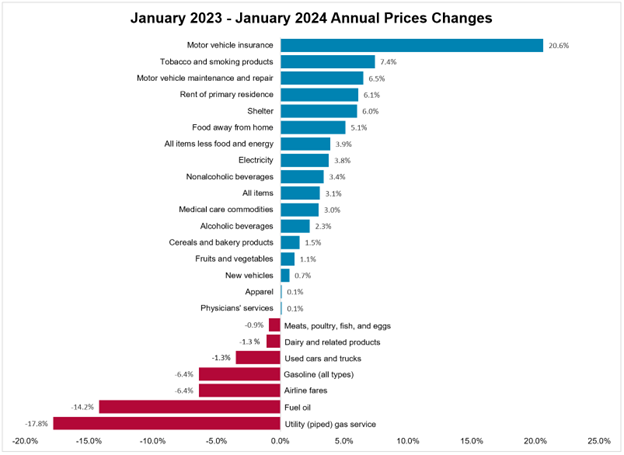

The Consumer Price Index was up 3.1 percent over the year through January, down from 3.4 percent in December. However, the monthly inflation has not changed, it was 0.3 percent both in December and January. The core inflation, which strips volatile food and energy prices, was 3.9 percent in January – unchanged from December and a monthly increase of 0.4 percent.

Despite the overall trend of cooling inflation – it peaked at 9.1 percent in the summer of 2022, the report is underwhelming as economists and analysts predicted a 2.9 percent increase. Traders adjusted their forecasts for Fed actions and sharply decreased the odds of rate cuts in March and May meetings. The Fed has raised interest rates to about 5.3 from near zero in 2022 to combat inflation and only recently paused the rate hikes due to the inflation slowdown.

Another concern for the Fed is service price increases such as airline fares and hotel prices. Service inflation is driven by wage growth and tends to be stubborn. Some analysts argue that bringing inflation down the rest of the way to normal will be the hardest since the economy is doing well. However, it’s worth noting that so far, the impact of rate increases on the economy has been less painful than expected.