FED MAINTAINS RATES, SIGNALS CAUTIOUS PIVOT TOWARD EASING:

A Balancing Act in Uncertain Times

The Federal Open Market Committee (FOMC) concluded its December meeting with a measured decision to hold interest rates steady, signaling a potential shift toward a more dovish stance in the face of economic headwinds. While the target range for the federal funds rate remains at 5.25% to 5.50%, this marks a significant departure from the recent hawkish posture, suggesting a heightened awareness of the evolving economic landscape.

The FOMC statement acknowledged the ongoing slowdown in economic activity and the moderating, albeit still elevated, levels of inflation. This recognition led to a shift in emphasis, with the statement highlighting the importance of “closely monitoring incoming data and economic developments” before considering further rate adjustments. This cautious tone suggests that the era of aggressive hikes may be nearing its end, replaced by a data-driven approach focused on navigating the uncertainties of the current economic climate.

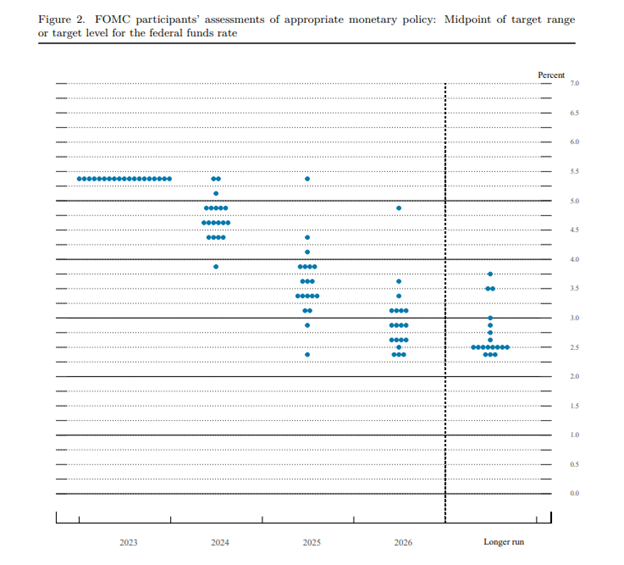

Further solidifying this pivot are the accompanying economic projections released by the FOMC. The median forecast among committee members anticipates a gradual decline in interest rates throughout 2024, with the year ending at 4.6%. This translates to at least three potential rate cuts, marking a noteworthy departure from the hawkish sentiment that dominated recent months. In September, the FOMC’s median projection for 2024 was at 5.1%.

Financial markets responded positively to the news, with both stocks and bonds experiencing upward movement. Investors welcomed the Fed’s signal for future easing, viewing it as a necessary step to mitigate the risks associated with a slowing economy. This positive response underscores the delicate balancing act the Fed faces in the coming months.

However, navigating this path will not be without its challenges. Inflation, while declining, remains above the Fed’s 2% target, necessitating continued vigilance against inflationary pressures. Additionally, the global economic slowdown poses potential risks to domestic economic growth, requiring the Fed to maintain flexibility in its policy approach.

In conclusion, the FOMC’s decision represents a pivotal moment in its monetary policy strategy. While holding rates steady, the signal for future easing is clear. The Fed now faces the crucial task of navigating this delicate balancing act, aiming to combat inflation while supporting economic growth in the face of significant uncertainties. The success of this endeavor will have far-reaching implications for financial markets and the trajectory of the American economy.