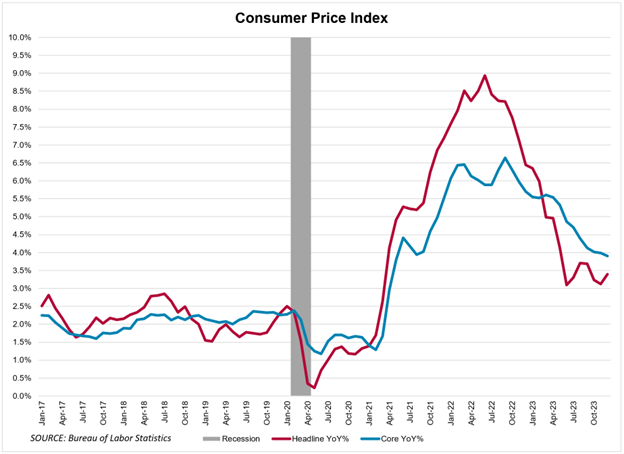

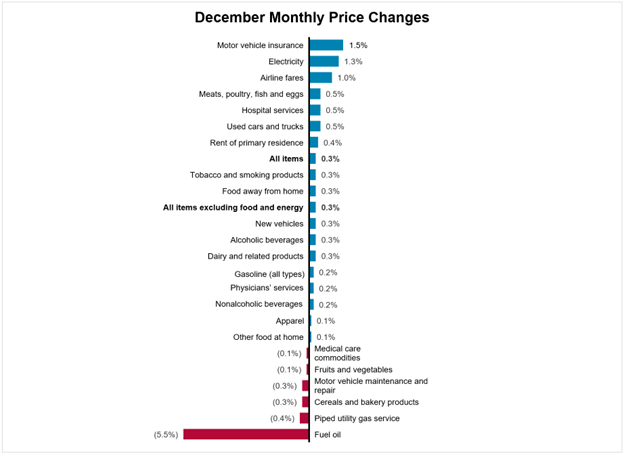

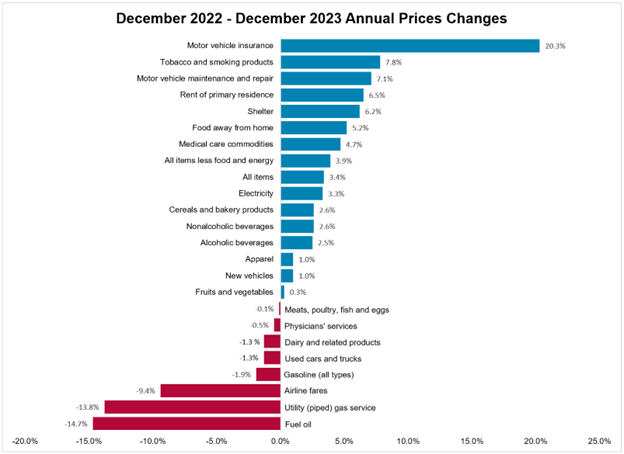

Inflation was up 3.4 percent year-over-year through December, up from 3.1 percent in November – a monthly increase of 0.3 percent. The core inflation, a measure that excludes energy and food prices, was up 3.9 percent over the twelve months through December, down from 4.0 percent in November. This marks the first time the core index dropped below 4 percent since May of 2021. The monthly core inflation in December was 0.3 percent as well.

Despite the month-to-month bumps, the data shows that inflation is decreasing and edging closer to the Fed’s target of 2 percent. However, it’s worth pointing out that certain categories, such as motor vehicle insurance and maintenance, have gone up noticeably over the past 12 months.

Many experts expect inflation to keep moderating in the coming months as the economy overall settles back into a more normal pattern. Central bankers are expected to start cutting rates sometime this year. The rates have gone up from near-zero in 2022 to 5.25-5.50, where they still stand today. The Fed needs to get the timing right on the rate cuts. If the rates are cut too soon, inflation might pick up pace again. If they remain high for too long, the economy might tip into a recession. If they are cut at the right time, the long desired “soft landing” might come to fruition.