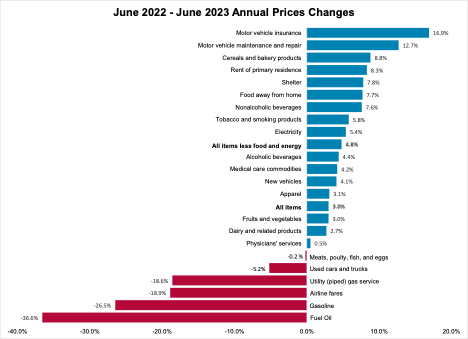

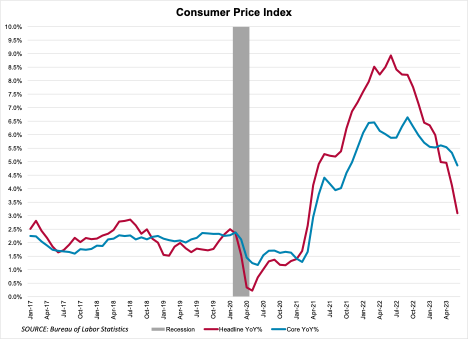

Inflation was up 3.0 percent in the year through June, down from 4.0 percent in May – the slowest pace since March 2021. The core inflation, a measure that excludes energy and food prices, was up 4.8 percent over the twelve months through June, down from 5.3 percent in May.

Despite the slowdown, CPI is still above the Fed’s target rate of 2.0 percent. The Fed officials continue to be wary of inflation staying elevated for an extended period and becoming a permanent feature of the economy. Hence, the Fed is likely to further raise interest rates at the next FOMC meeting on July 25-26. Current FOMC projections have the Federal Funds Rate ending 2023 at 5.6 percent, implying two more potential interest rate hikes this year.

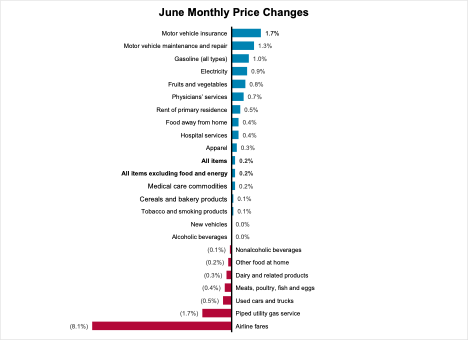

On a monthly basis, both headline and core indices climbed 0.2 percent – the slowest pace for the core CPI since August 2021. Airfares declined the most – plummeting 8.1 percent. Moreover, used car prices also fell and new car prices stayed flat due to higher interest rates and inventories recovering from pandemic disruptions to production. Price increases for food and shelter also slowed in June.