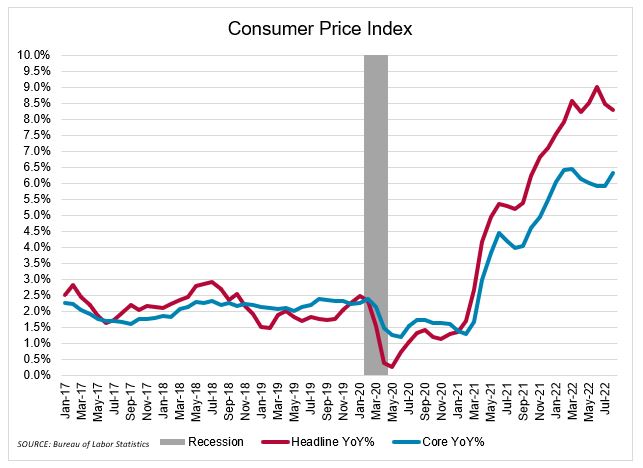

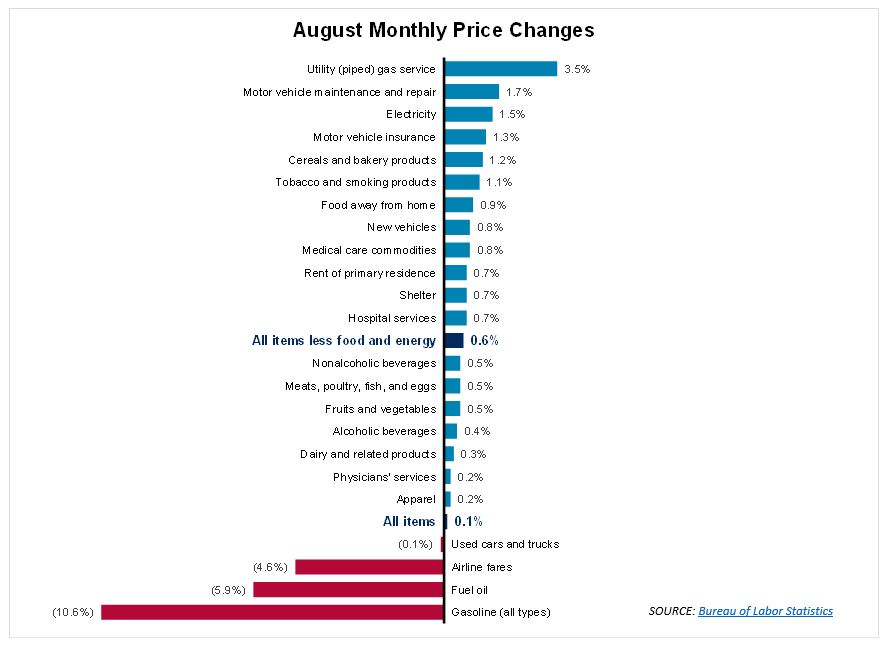

Despite the lower gas prices, which have fallen for 91 straight days, inflation rose 8.3 percent in August from the prior year. Compared to 8.5 percent in July. The August report is disappointing as the economists and experts expected a more pronounced decline in CPI growth. On the news, the S&P 500 dropped over 4 percent, the largest drop in the index since June 2020.

The decline in fuel prices was offset by the rising costs for rent, healthcare, and goods such as furniture. Moreover, the less volatile Core CPI, which excludes energy and food prices, increased by 6.3 percent in the year through August. The consensus average of economists had expected an increase of only 6.1 percent. The Core CPI increase, a closely watched metric by the Fed, coupled with a strong labor market, will encourage an increase of the Federal Funds Rate by at least another 75 basis points at the meeting next week. The probability of a potential 100 basis point hike by the Fed increased 30 percent after the report.

Rising rents, which account for nearly a third of the overall inflation, are particularly worrisome and tricky to tackle for the Fed. Increasing interest rates prices out more would-be homeowners from the market and drives up demand for rental units. The strong labor market also contributes to the rising rents.