GDP Declines for the Second Consecutive Quarter: Are We in a Recession?

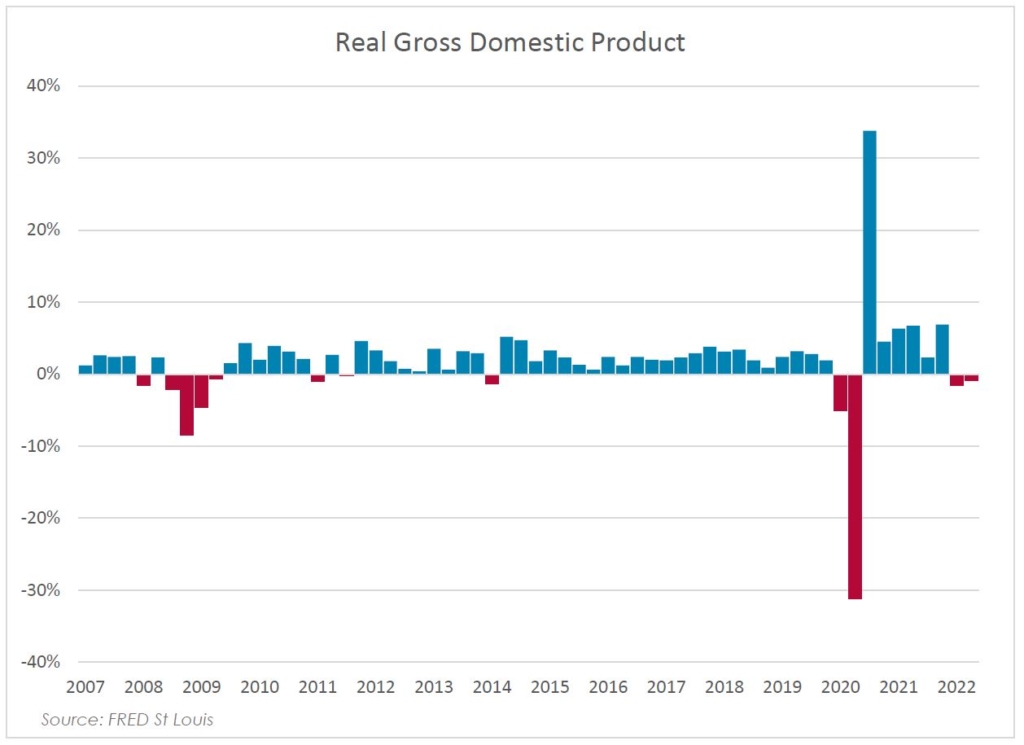

On July 28th, the first reading on Q2 GDP was released showing a contraction of 0.9 percent. This is following the Q1 contraction of 1.6 percent. The decline of GDP for two consecutive quarters is widely considered to be a recession. In the US, however, a definition is more expansive. The National Bureau of Economic Research, a nonprofit economic research organization that determines start and end dates of recessions, also considers income, employment, industrial production, and retail sales data in addition to GDP.

The bureau’s Business Cycle Dating Committee declarations about recessions are retrospective – identified several months after a decline has begun. All the same, we can look at the recent data of the five abovementioned metrics and see where we are now.

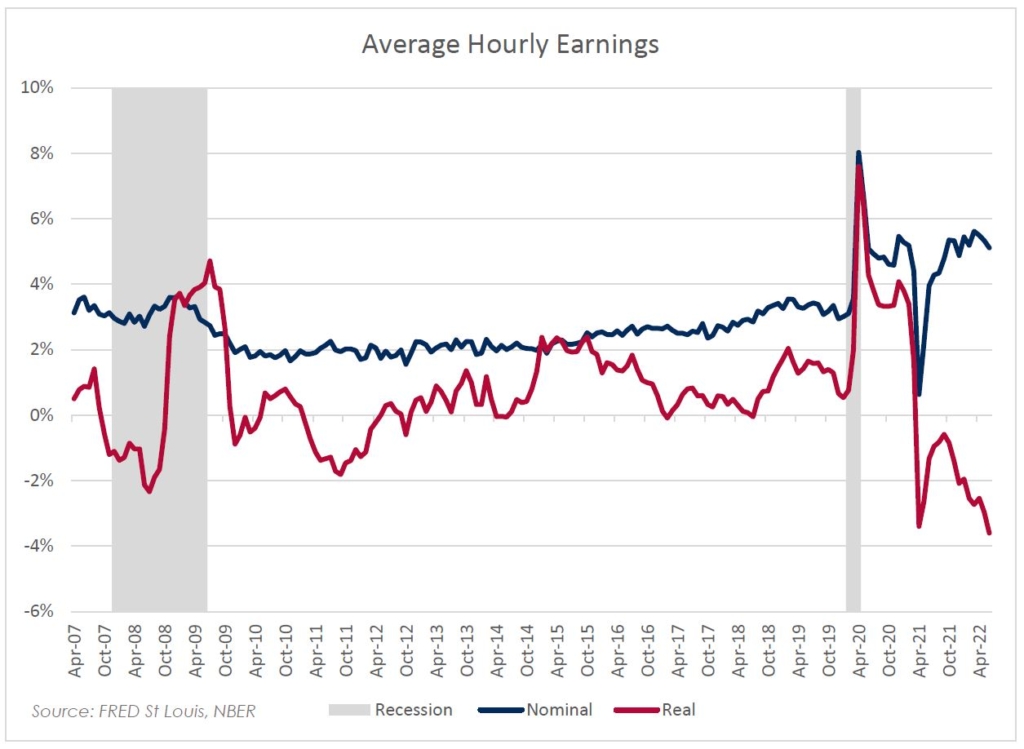

First, let’s look at the recent income data. Nominal average hourly earnings have increased by 5.1 percent over the 12 months ending in June; however, the real earnings decreased by 3.6 percent due to inflation. The graph below shows the percentage change from a year ago, both for nominal, as well as real wages. As you can see, due to inflation, real and nominal earnings started to diverge. The nominal wages are increasing but not enough to offset inflation, resulting in lower real earnings.

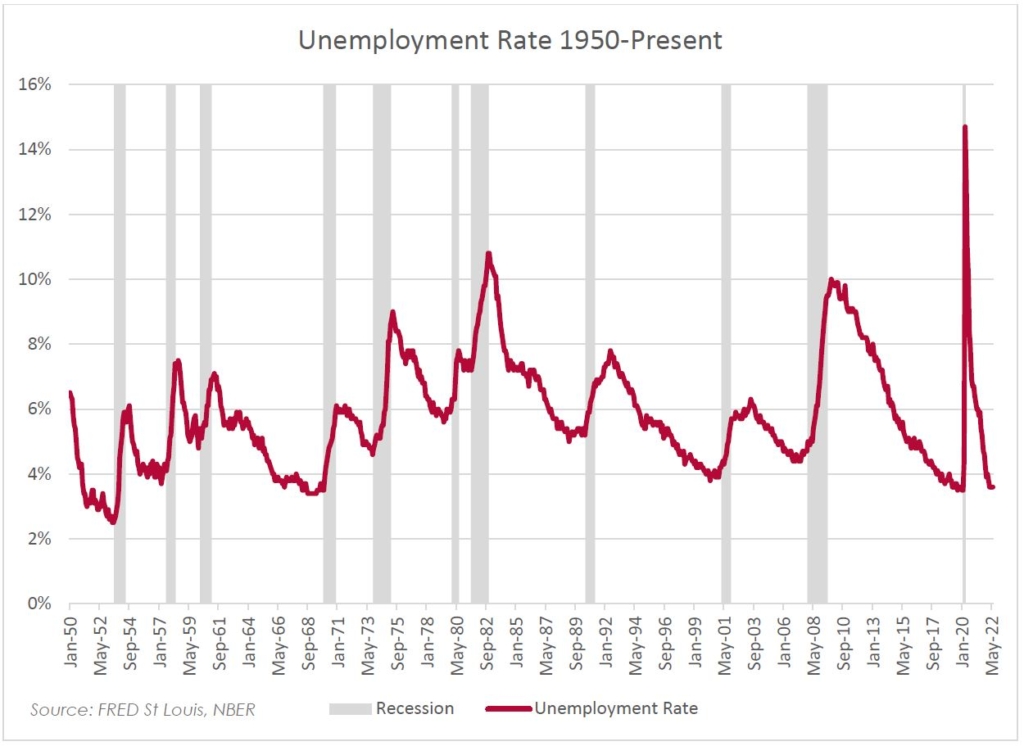

The second metric we will look at is the unemployment rate. The U.S. economy added 372,000 jobs in June, exceeding economists’ expectations by around 100,000. The unemployment rate remained steady at 3.6 percent, near the 50-year low. Since the job market is strong, and not indicative of a recession, it encouraged the Fed to further raise the interest rates by 75 BPS on July 27th, with additional hikes anticipated.

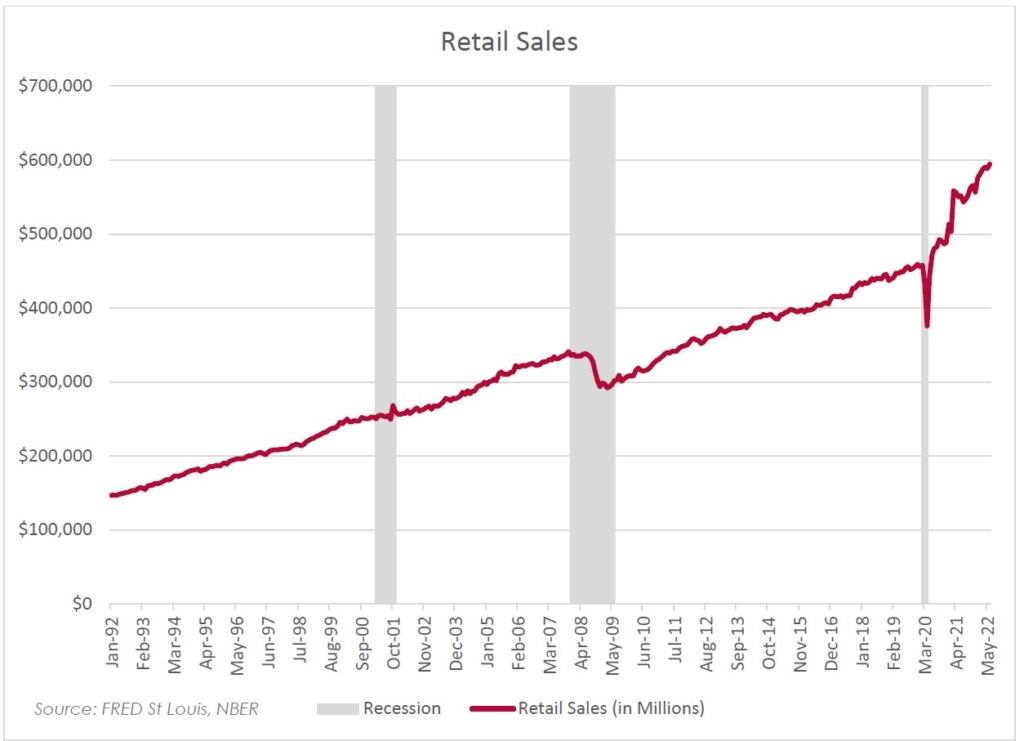

Another key metric is retail sales, which increased 1 percent in June. However, this does not consider the monthly 1.3 percent inflation increase. Thus, the actual retail sales went down 0.3 percent.[1] Nevertheless, the 1 percent increase beat the experts’ estimate of 0.9 and stocks rallied after the announcement. During the Great Recession, the retail sales declined 17 percent from peak to trough – from November 2007 to March 2009. Comparing that to current stagnating sales (after inflation), retail sales data does not point to a recession.

Source: https://www.cnbc.com/2022/07/15/retail-sales-june-2022-.html

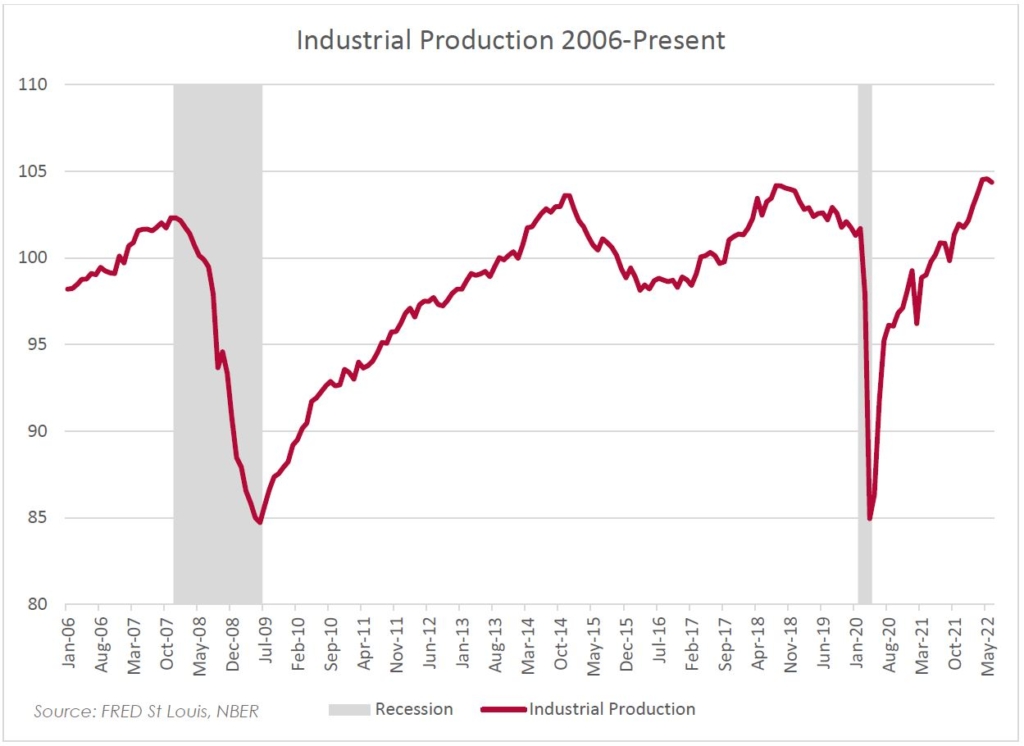

Industrial Production (IP) is another NBER metric. It fell 0.2 percent in June. However, it was growing up until that point. Also, as the chart below demonstrates, Industrial Production often falls without an accompanying recession such as the decline from 2014 to 2016. Also, the current expansion had dips in September 2020, and February 2021, among others. Moreover, for IP makes up only 15 percent of GDP.[1] So far, Industrial Production is not currently indicating a recession.

Source: https://www.fisherinvestments.com/en-us/marketminder/ip-doesnt-spell-recession

Despite the two consecutive quarters of declining GDP, based on NBER metrics, the U.S. economy does not appear to be in a recession. The unemployment rate is steady near a 50-year low. Inflation adjusted hourly earnings and retail sales have seen only minor declines. Furthermore, Industrial Production had only one month’s dip which cannot be relied upon given its frequency to decline without any correlation with a recession. These metrics will encourage the Fed to further increase the interest rates to tackle inflation.

If wages, retail sales, and industrial production keep declining in the upcoming months, it’s foreseeable that unemployment rate will also rise. This may lead to another quarterly contraction of GDP and at that point, the U.S. economy will more than likely be in a recession. The bond market has been signaling the probability of a recession, as the yield curve has been inverted for nearly the entire month of July. The severity and duration of said recession remains to be seen.